2024 Form 1040 Schedule C-Ez – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

2024 Form 1040 Schedule C-Ez

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule D: Capital Gains and Losses?

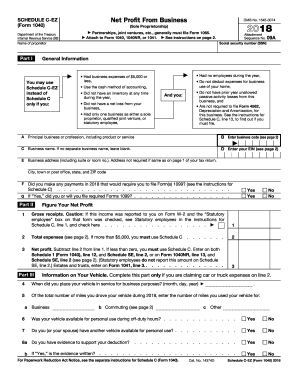

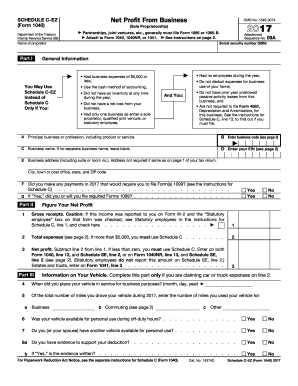

Source : www.investopedia.comIRS 1040 Schedule C EZ 2018 2024 Fill and Sign Printable

Source : www.uslegalforms.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

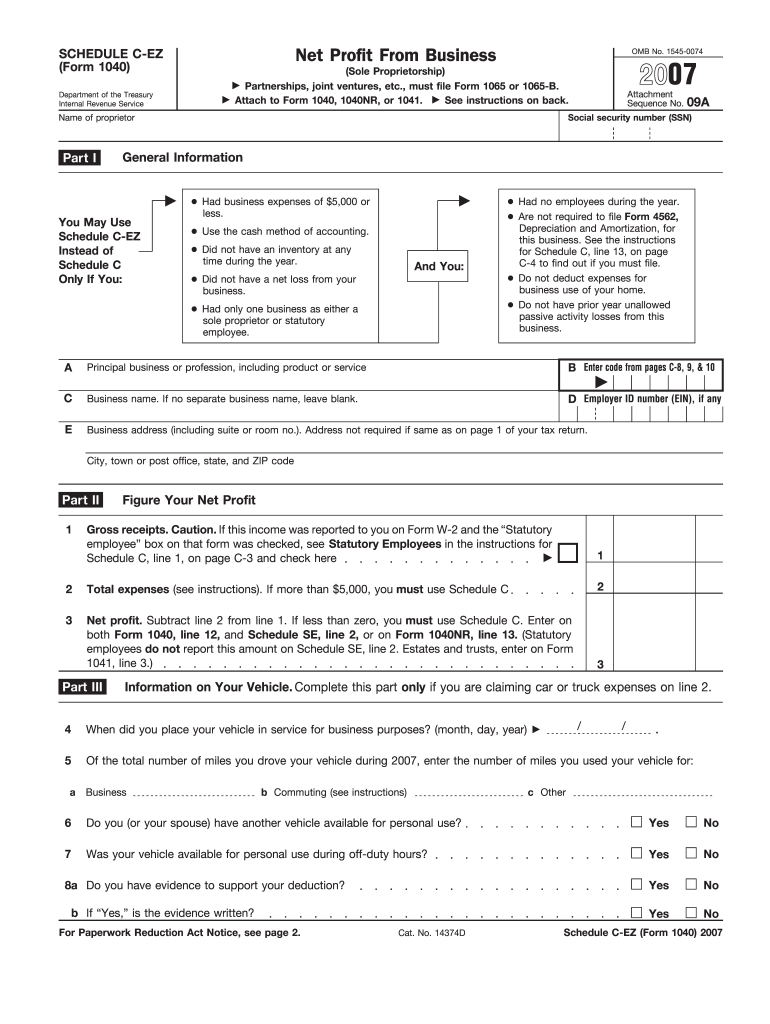

Source : pdfliner.comSchedule c ez: Fill out & sign online | DocHub

Source : www.dochub.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

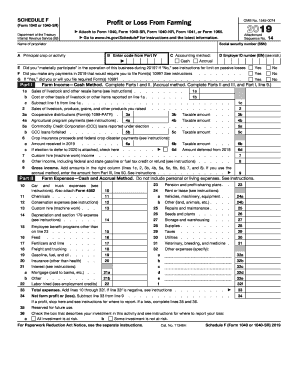

Source : finance.yahoo.comIRS Schedule F (1040 form) | pdfFiller

Source : www.pdffiller.comSchedule C EZ Form Fill Out and Sign Printable PDF Template

Source : www.signnow.comSchedule c tax form: Fill out & sign online | DocHub

Source : www.dochub.comWhat is an IRS Schedule C Form?

Source : falconexpenses.com2024 Form 1040 Schedule C-Ez 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Obtain a copy of IRS Schedule C (Form 1040), or Schedule C-EZ, if applicable, Schedule SE and Form 1040. Determine your total freelance income by totaling all income for which you received 1099s. . or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 Line 1 as employment wages. The IRS ruled that cryptocurrencies are “property” in IRS Notice 2014-21 .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)