2024 Form 1040 Schedule 6 Months – Employees can only deduct their clothing expenses as miscellaneous uniform deductions on their Form 1040, Schedule A expenses and enter them in line 6. Complete line 4 of Form 2106 by entering . For example, assume you want to know your total income for a month of part-time work You will need to pay taxes on these amounts on your Form 1040 Schedule C and Form 1040 Schedule SE. .

2024 Form 1040 Schedule 6 Months

Source : thecollegeinvestor.comIRS Form 706: Who Must File It and Related Forms

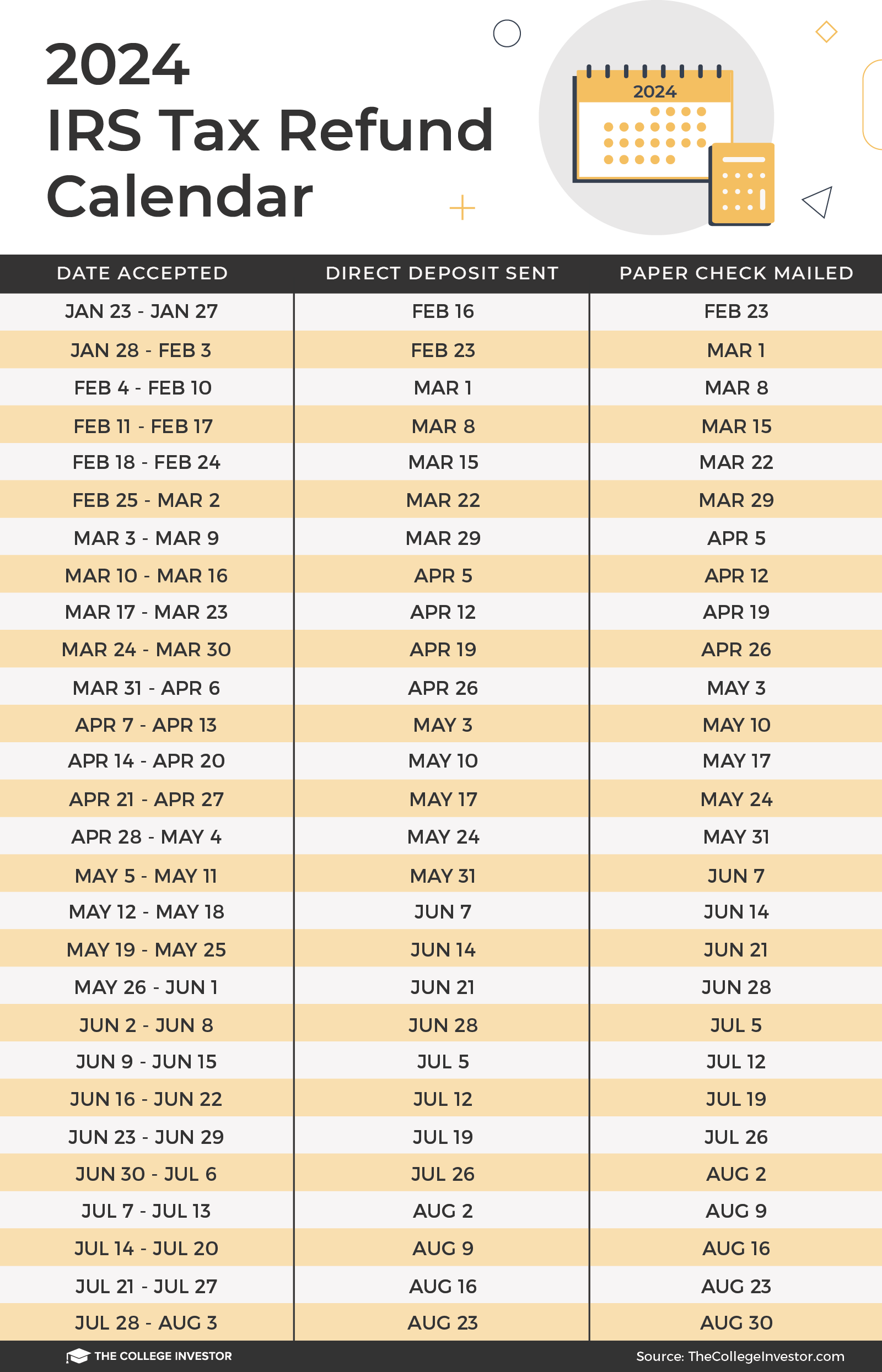

Source : www.investopedia.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comD 4 Public Health on X: “Enrichment Services Program, Inc. (ESP

Source : twitter.comFICA Tax Refund Timeline About 6 Months with Employer Letter and

Source : thirstymag.com25 Best Tax Preparation Service Near Salem, Oregon | Facebook

Source : z-upload.facebook.comWhat Is Form 1040 X? Definition, Purpose, and How to File

Source : www.investopedia.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com2024 Form 1040 ES

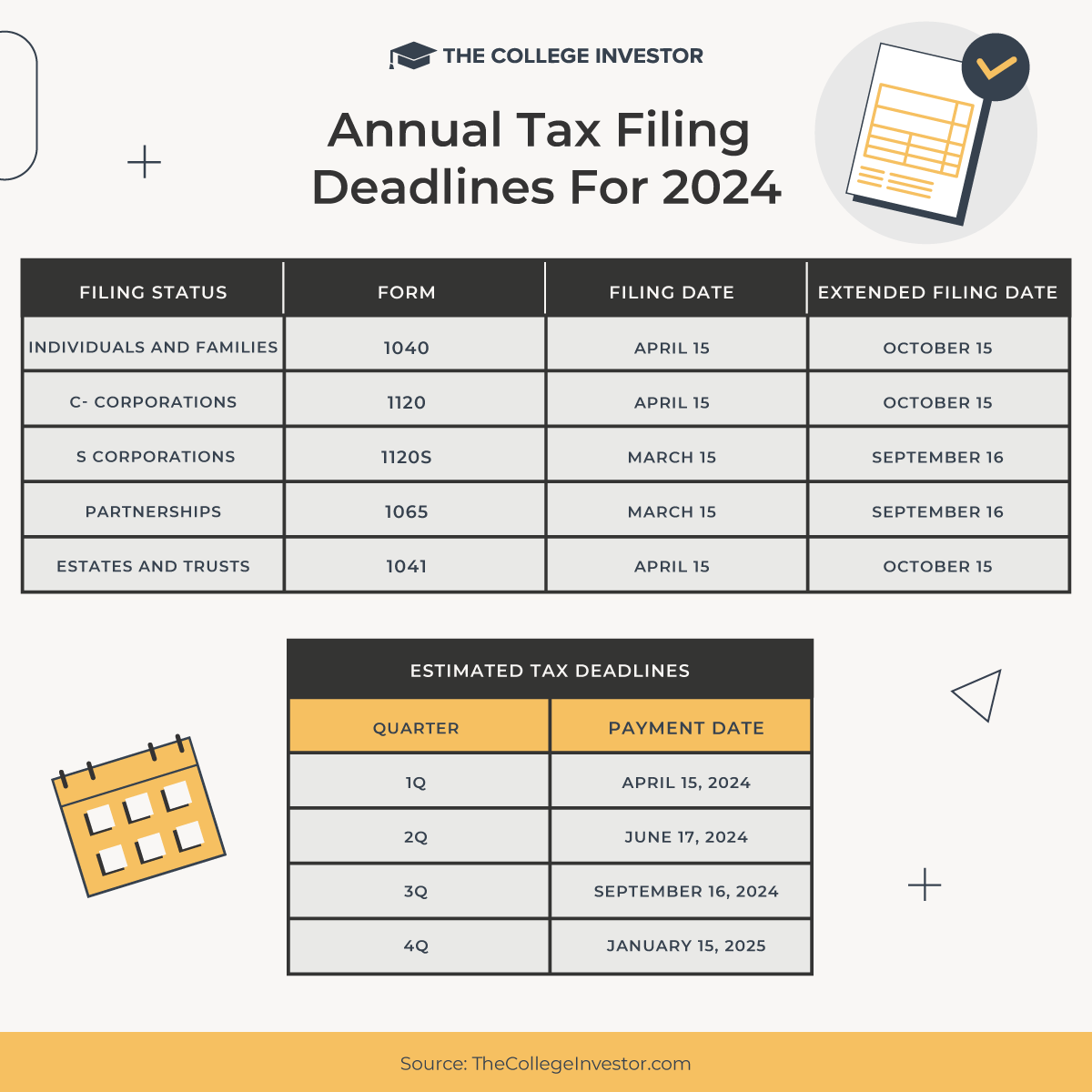

Source : www.irs.gov2024 Form 1040 Schedule 6 Months Tax Due Dates For 2024 (Including Estimated Taxes): This guide provides information on the different payroll tax forms and deadlines specific to household employers, helping you navigate the process with ease. . Keep reading to find out everything you should know about Form 1040 for tax year 2022. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from 5.83% to 6.83%. .

]]>

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

:max_bytes(150000):strip_icc()/1040xtop-d338e5af0027469aa2b5e1d7c0f2c909.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)